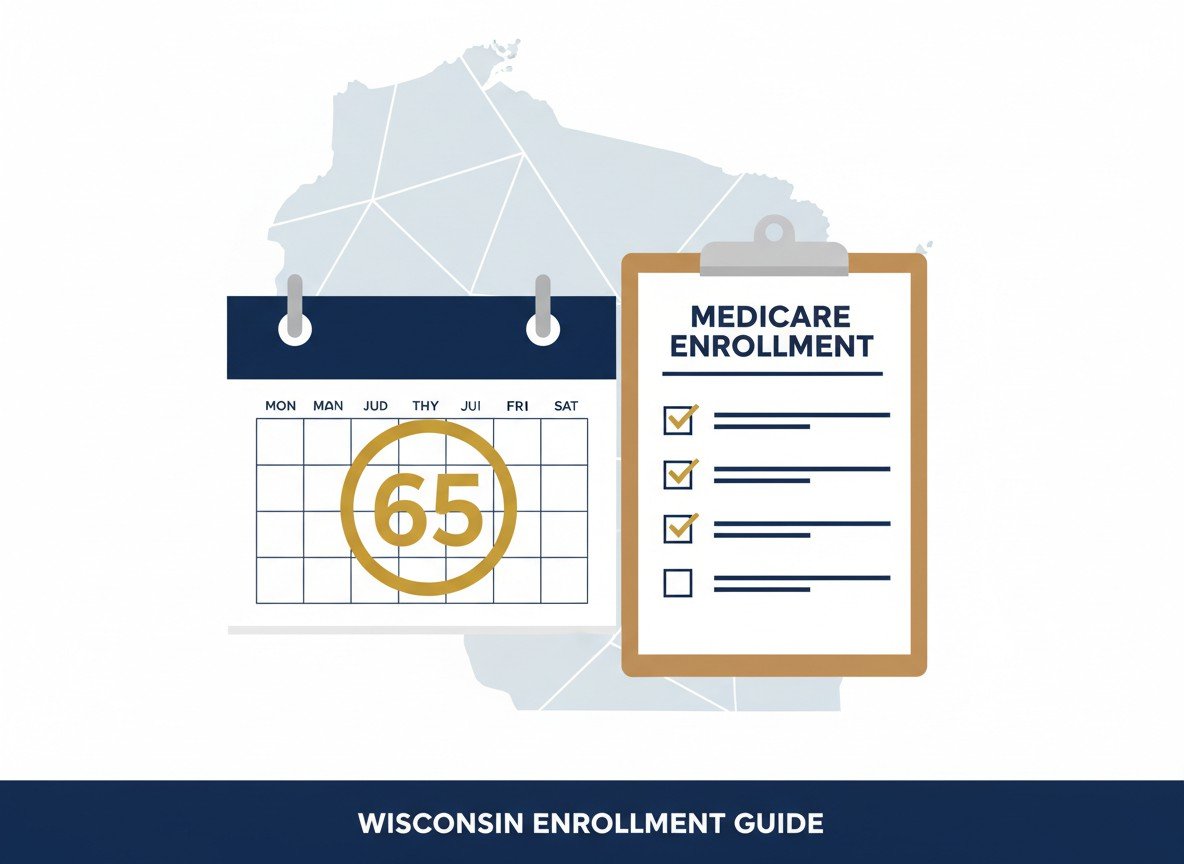

A Step-by-Step Medicare Enrollment Checklist for Wisconsin Residents Turning 65

Introduction (2–3 paragraphs) If you’re turning 65 in Wisconsin, Medicare enrollment can feel like a lot: multiple “parts,” multiple timelines, and different rules depending on whether you’re retiring, still working, or covered under a spouse’s employer plan. The good news is that once you understand the timing, the process becomes much more manageable.

This guide is an educational, CMS-compliant overview of how Medicare enrollment typically works when you turn 65. We’ll walk through the key enrollment periods, what documents to gather, how to avoid common mistakes, and where Wisconsin-specific considerations may come into play. Note: This article is for education only. It does not recommend any plan or carrier.

Start Here: What “Turning 65” Means for Medicare

Eligibility Most people become eligible for Medicare at age 65. Your enrollment timing depends on your situation.

The 3 most common situations at 65

- You’re retiring and need Medicare to replace employer coverage

- You’re still working and have employer coverage

- You’re covered under a spouse’s employer plan

Medicare isn’t automatic for everyone

Some people are enrolled automatically, while others must actively sign up. It depends on factors like whether you’re already receiving Social Security.

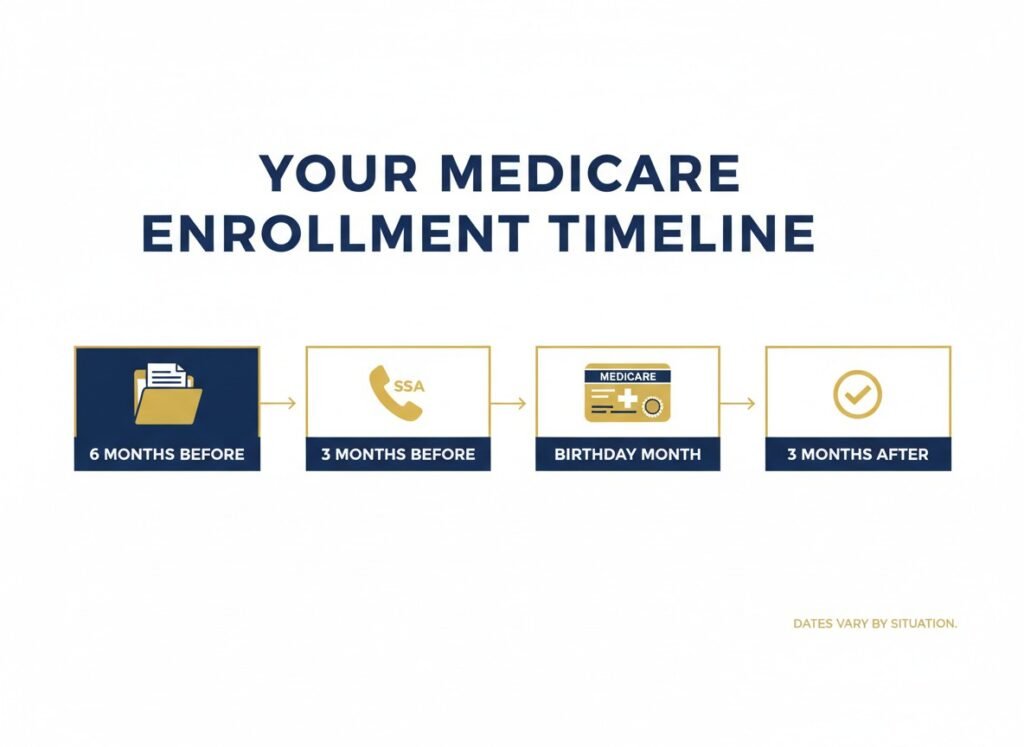

The Medicare Enrollment Periods You Need to Know

Understanding these windows is the foundation of a smooth enrollment.

Initial Enrollment Period (IEP)

Your Initial Enrollment Period is a 7-month window: – 3 months before your 65th birthday month – Your birthday month – 3 months after your birthday month Why it matters: Enrolling earlier can help prevent gaps in coverage.

Special Enrollment Period (SEP) for employer coverage

If you (or your spouse) have qualifying employer coverage, you may be able to delay certain parts of Medicare without penalty and enroll later using a Special Enrollment Period. Important: Rules can depend on employer size and the type of coverage. Confirm details with your employer benefits administrator and official Medicare resources.

General Enrollment Period (GEP)

If you miss your IEP and don’t qualify for an SEP, you may have to wait for the General Enrollment Period to enroll.

Annual Enrollment Period (AEP)

AEP happens each year (Oct 15–Dec 7) and is typically when people review or change certain Medicare coverage options. Educational note: This guide focuses on first-time enrollment at 65.

What to Enroll In: Parts A, B, D (and Where Part C Fits)

Medicare is commonly discussed in “parts.” Here’s the big-picture role of each.

Part A (Hospital Insurance)

Part A generally helps cover inpatient hospital care and certain facility-based services.

Part B (Medical Insurance)

Part B generally helps cover outpatient care, doctor services, preventive services, and more.

Part D (Prescription Drug Coverage)

Part D generally helps cover outpatient prescription medications.

Part C (Medicare Advantage)

Part C is an alternative way to receive Part A and Part B through a private plan that follows Medicare rules. This article does not compare plan benefits or recommend a plan.

A Wisconsin-Friendly Timeline: When to Start (3–6

Months Before 65) A simple way to reduce stress is to start early.

6 months before your 65th birthday

- Make a list of your current doctors, clinics, and hospitals

- List your prescriptions (name, dose, frequency)

- Gather your current insurance cards and plan information

3 months before your 65th birthday

- Decide whether you’re enrolling in Medicare now or delaying due to employer coverage

- If enrolling, start the Medicare application process

- If delaying, confirm employer coverage rules and keep documentation

Your birthday month and after

- Confirm your Medicare effective dates

- Set up your Medicare account and store your documents

- Schedule a plan review/check-in if you want help understanding options

How to Enroll in Medicare (Step-by-Step)

Enrollment can be done through official channels.

Step 1: Confirm whether you’ll be enrolled automatically

If you’re already receiving Social Security benefits before 65, you may be automatically enrolled in Medicare Part A and Part B. If not, you’ll likely need to enroll.

Step 2: Enroll through Social Security (most common)

Many people enroll in Medicare through the Social Security Administration (SSA), either online, by phone, or in person.

Step 3: Choose how you’ll receive coverage

After you have Medicare, you may consider additional coverage options depending on your needs (for example, prescription coverage and/or supplemental coverage). Rules and availability vary.

Step 4: Keep proof of coverage and effective dates

Save: – Your Medicare number and effective dates – Any employer coverage letters (if delaying) – Enrollment confirmations

Working Past 65 in Wisconsin: Employer Coverage and

Medicare (High-Level) This is one of the biggest sources of confusion.

Employer size can matter

In some cases, whether the employer has 20+ employees can affect how Medicare coordinates with employer coverage.

Questions to ask your HR/benefits team

- Is my coverage considered “creditable” for Medicare purposes?

- How does my plan coordinate with Medicare?

- If I delay Part B, what documentation will I need later?

- What happens to my coverage when I retire?

Don’t assume COBRA is the same as active employer coverage

COBRA rules can be different from active employer coverage when it comes to Medicare timing.

Common Medicare Enrollment Mistakes (and How to

Avoid Them) A few preventable mistakes can create headaches.

Mistake 1: Waiting too long to start

Even if you’re organized, gathering documents and confirming effective dates takes time.

Mistake 2: Not understanding Part B timing

Part B timing is a frequent issue—especially for people who delay due to employer coverage.

Mistake 3: Missing prescription coverage planning

If you take medications, understanding how prescription coverage works can be important.

Mistake 4: Confusing enrollment periods

IEP, SEP, GEP, AEP—these acronyms matter. Write down your personal dates.

Mistake 5: Not keeping documentation

If you delay enrollment, documentation can be essential later.

Wisconsin-Specific Notes: What’s Different Here?

Medicare is federal, but Wisconsin has a few unique considerations.

Wisconsin Medigap standardization is unique

Wisconsin is one of the states with its own Medigap standardization approach. If you explore supplemental coverage, the structure may look different than what you see in national articles.

Local provider systems and access

Depending on where you live (Milwaukee County, Waukesha County, Green Bay area, Dane County, etc.), provider access and networks (if applicable) can differ.

Community support and language needs

If English isn’t your first language, it’s okay to ask for help understanding terms and deadlines. Many Wisconsin families also coordinate Medicare decisions across generations.

Turning 65 Checklist (Printable-Style)

Use this as a quick reference.

Documents to gather

- Social Security number

- Proof of U.S. citizenship or lawful presence (if required)

- Current health insurance card(s)

- Employer coverage information (if working)

- Prescription list

Dates to write down

- Your 65th birthday month

- Start/end of your Initial Enrollment Period

- Retirement date (if applicable)

- Employer coverage end date (if applicable)

Actions to complete

1. Confirm whether you’re enrolling now or delaying due to employer coverage

2. Apply for Medicare (if needed)

3. Confirm effective dates

4. Review coverage options for prescriptions and additional coverage (if needed)

5. Save all confirmations and documents Suggested Internal Links

- What Does Medicare Cover — and What Does It Not Cover?

- Medicare Advantage vs Original Medicare: How to Think About the Differences

- Why Original Medicare Has No Out-of-Pocket Maximum

- Medicare Glossary: Key Terms for Beginners

- Medicare Enrollment Periods Explained (Wisconsin) Suggested External Resources

- Social Security Administration: Apply for Medicare

- Medicare.gov: Getting Started with Medicare

- Medicare.gov: Enrollment Periods

- Medicare.gov: Find Care Providers

- Wisconsin Board on Aging and Long Term Care (resource for seniors)

Key Takeaways

- Your Initial Enrollment Period is a 7-month window around your 65th birthday.

- If you have qualifying employer coverage, you may be able to delay certain parts of Medicare and use a Special Enrollment Period later.

- Starting 3–6 months early helps you avoid gaps, delays, and common mistakes.

- Wisconsin has unique Medigap standardization rules, and local provider access can vary by area.

- Keep documentation—especially if you delay enrollment due to employer coverage.

FAQ Section

When should I apply for Medicare if I’m turning 65?

Many people start 3 months before their birthday month to help coverage begin on time. Your best timing depends on your situation.

Do I have to enroll in Medicare at 65 if I’m still working?

Not always. Some people with qualifying employer coverage may be able to delay certain parts. Confirm with your employer and Medicare.

What if I miss my Initial Enrollment Period?

If you miss your IEP and don’t qualify for a Special Enrollment Period, you may have to wait for the General Enrollment Period and could face late enrollment penalties.

What’s the difference between enrolling in Medicare and choosing

additional coverage? Enrolling in Medicare usually refers to signing up for Parts A and/or B through SSA. After that, you may choose additional coverage options (like prescription coverage) depending on your needs.

Is Medicare enrollment different in Wisconsin?

The enrollment process is federal, but supplemental coverage structures (like Medigap standardization) and local provider access can differ. CMS Disclaimer This content is for educational purposes only and does not constitute plan advice. Coverage and eligibility may vary by individual situation.